Search

Search

Search

Search

Halliburton’s unique evaluation process and unmatched shale experience helped customers separate economical plays from cost-prohibitive ones

Download PDFUnconventionals

Asset evaluation and risk assessment of unconventional fields

Global

The marginal economics of shale are well-known. Decisions to invest in a shale asset must consider all potential risks and benefits. Misunderstanding even one variable could mean the difference between profit and loss.

Halliburton leads the industry in developing shale plays and has created a method to evaluate the economics of these investments. The process helps clients understand when and where they can generate income, both in the early stages of development and later in the asset's life cycle. Halliburton consulting helped two operators make critical decisions about potential shale plays, enabling both to make informed investment decisions. One profited by acting quickly. The other profited by walking away.

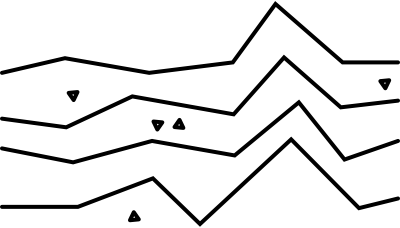

Shale plays can be risky investments. Operators want to know the size of the resource, potential risks, net present value, and projected rate of return ahead of time. This requires understanding the mineralogy of the shale, total hydrocarbons in place, and other critical factors, like pay depth, thickness, and brittleness. Halliburton Consulting has both the knowledge and tools to help find and filter data that helps ensure the operator can make informed, actionable investment decisions that meet their financial objectives and risk profile. Global experience, extensive databases, and workflows designed for unconventional resources help answer operators’ questions.

Shale production is notoriously difficult to predict. No two shale plays are alike, and shale produces differently than conventional assets. Halliburton Consulting leverages extensive shale experience and advanced tools to provide operators with reliable data and actionable investment insights, ensuring informed decisions that align with financial objectives and risk profiles. Halliburton Consulting collaborates internally with drilling and fracturing teams to make accurate predictions, assess well designs, and validate investment costs and returns, boosting client confidence.

By applying knowledge gained from shale plays in the United States and elsewhere, Halliburton can help operators compress the discovery period in newly developing areas. Halliburton helps clients understand the potential of a lease, applicable environmental regulations, and scenarios that affect asset value. By providing an unbiased picture of development costs and cash flow, operators can determine if the investment is worthwhile.

Investment opportunities exist at various stages of a shale asset’s lifecycle. One operator considered acquiring mineral leases early in the lifecycle of a shale asset in Ohio, seeking oil-producing leases. Halliburton Consulting worked closely with the operator to analyze this potential investment.

Extensive analysis included a series of modeling exercises to determine the hydrocarbon distribution across several areas within the shale play. Halliburton experts analyzed three areas based on the operator’s investment criteria. With that information, the operator made informed decisions about whether and where to invest.

Another operator with limited experience in unconventional plays asked Halliburton to analyze a potential investment in a proven shale play approaching full development. Halliburton conducted a technical analysis of the field, economic assessments, and expected ultimate recovery. Consultants examined historical analogs and other key factors in making recommendations. The techno-economic analysis also considered the reservoir depth, hydrocarbon saturation, shale mineralogy, pay zone thickness, and the likelihood of a natural fracture network.

Halliburton reported the potential risks of investing in the play and the floor value of the assets. They also recommended development scenarios that could provide the highest rates of return. During the engagement, Halliburton consultants mentored the management team on key technical and business issues related to shale.

Halliburton consultants assess and collaboratively design engineered solutions to continuously improve asset value.